Crop Protection By Syngenta

by Syngenta

Price:  0

0

0

0

0

0

0

0

You Save:  0

0

0

0

by Syngenta

Price:  315

315

300

300

315

315

300

300

You Save:  -9%

-9%

-9%

-9%

by Syngenta

Price:  220

220

380

380

220

220

380

380

You Save:  -45%

-45%

-45%

-45%

by Syngenta

Price:  320

320

300

300

320

320

300

300

You Save:  -15%

-15%

-15%

-15%

by Syngenta

Price:  630

630

349

349

630

630

349

349

You Save:  -21%

-21%

-21%

-21%

by Syngenta

Price:  0

0

0

0

0

0

0

0

You Save:  0

0

0

0

by Syngenta

Price:  240

240

257

257

240

240

257

257

You Save:  -16%

-16%

-16%

-16%

by Syngenta

Price:  750

750

1000

1000

750

750

1000

1000

You Save:  -12%

-12%

-12%

-12%

Syngenta Karate 100ml Insecticide (Lambda-Cyhalothrin EC), Pack of 1 - Product Features

- Broad spectrum

- Novel granular formulation-pours like a liquid therefore easy to handle. High efficacy at low rates-very low residue on crops and short PHI

- Contact, residual and stomach action-ensures control whether or not the pest is directly hit or sprayed.

- Scent Name: Unscented

SYNGENTA Score Difenoconazole 25 % Ec (50 ml) - Product Features

- Volume: 50 ml

- Included Items: 1 Score Difenoconazole 25 % Ec, 50 ml

- Safety Instructions: Do not bring this product in contact with water or other corrosive liquids

- Size (L x W x H): 6 cm x 4 cm x 6 cm

Syngenta ICON 10WP 125GM (Lambda-cyhalothrin 10% WP) Mosquito Control Chemical - Product Features

- designed for indoor residual spraying.

- delivers long-lasting control of cockroaches, flies, mosquitoes

Syngenta Actara, Thiamethoxam 25% WG, Insect/Pest Repellent (100gm) - Product Features

- Active Ingredients: Thiamethoxam 25% WG

- Dosage: 0.5 gm/litre of water and 100 gm in 200 liters of water per acre

- Effective for:Aphids, Ash weevil, Black aphids, Brown plant leafhopper, Bugs, Cardamom aphid, Chilli thrips, Fruit rust thrips, Grape thrips, hispa, Jassids, Mango hoppers, Marginal gall thrips, Pod fly, Rice hispa, Rhizome weevil, Spiraling whitefly, sugarcane wolly aphid, White flies, White tail mealy bug, Mealy bugs, Anar butterfly may be managed by spraying Actara

- Quickly penetrates the leaf?s surface, and eliminates pests within 24 hours Establishes a reservoir of product within the leaf due to trans-stemic movement, resulting in long residual control Highly compatible with Integrated Pest Management programs

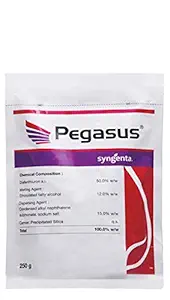

Syngenya Pegasus, Diafenthiuron 50% w/w, Insecticide (25gm x 3) - Product Features

- Active Ingredient: Diafenthiuron 50% w/w

- Main Crops: Cabbages, Broccoli, Cauliflower, Roses

- Rates of Application Apply at 0.8 - 1.0 litres/ha (low rate for whiteflies & high rates for mites)

- Degradation into urea derivative - phytotonic effect and yield increase.

- It is specially made for vegetables.

SYNGENTA Cultar, Paclobutrazol 23% SC, Plant Growth Regulator (50ml x 2) - Product Features

- Content: Paclobutrazol 23% SC

- Main Crops: Mango, Onion, Garlic, Potato, Groundnut, Carrot

- Benefits: Reduced shoot growth; increased fruit bud formation, flowering, and fruit set; improved fruit quality; greater frost, pest, and disease tolerance; and reduced pruning demands. Early Flowering. Increases yield.

- Dose: /Acre20-25 ml per tree (Mango), 3-5 ml/15 litres of water (Onion, Garlic, Potato, Groundnut)

- the use of Cultar can advance and stimulate the flowering.

Syngenta Actara Insecticide, 100 Gram, Pack of 1 - Product Features

- Quantity :100 g

- Serves the purpose

- The product comes in proper packaging

- Scent Name: Unscented

Syngenta Icon 10 CS for Mosquitoes 100ml - Product Features

- Long-lasting residual control on a wide range of surfaces

- Potential for just one application per year covering both raining seasons

- Patented unit dose sachets ? no measuring ? accurate dosing

- Highly flexible tool for vector control as a residual treatment, space spray, or larvicide, Long-lasting residual control, Cost-effective and proven efficacy in malaria control programs across Africa, Asia and Latin America

- Excellent household acceptance with low odor and no staining, Patented unit dose pack enables accurate dosing and operator safety

syngenta Actara 5g x 10 Sachets - Product Features

- ACTARA is highly systemic and well suited for application as a foliar spray, drench or drip irrigation

- ACTARA is highly effective at low used-rates against a broad spectrum of sucking, soil and leaf-dwelling pests

N D Pest Control Cockroach Killer Gel for Home |Ant Killer Gel for Home | Repellent (45gm), Pack of 1 - Product Features

- 10 Wipe

- For House Hold Use

- Easy To Use

SYNGENTA Karate (100 ml) - Product Features

- Volume: 100 ml

- Included Items: 1 Karate, 100 ml

- Safety Instructions: Do not bring this product in contact with water or other corrosive liquids

- Size (L x W x H): 5 cm x 3 cm x 5 cm

Syngenta Alika Thiamethoxam 12.6% + Lambda Cyhalothrin 9.5% ZC Insecticide 80 ml - Product Features

- Thiamethoxam 12.6% + Lambda Cyhalothrin 9.5% ZC Insecticide

- Quantity: 80 ml

- Exhibits good overall crop outlook and better crop greening with more branches and flower initiation

Syngenta Fusiflex - Fluazifop-p-Butyl 13.4%EC, Herbicide (400ml) - Product Features

- Fusiflex gets quickly absorbed by leaves and translocates. It performs well in all weather conditions.

- Fusiflex is designed to perform dual action. Firstly it works through the leaf and then translocates to every part of plant. Secondly, it works through soil and enters through roots and reaches other parts of the weeds destroying them completely.

- The product controls key grass weeds and provides better crop establishment thus ensuring healthy growth.

- It is post- emergence selective herbicide for Soybean, Cotton and Ground Nut.

- Dose/acre - 400-500 ml /acre.

To ensure that as many farmers as possible are able to access the benefits, the Kisan Store has five Indian languages including Hindi, Telugu, Kannada, Tamil, and Malayalam. Farmers who prefer to shop offline at a neighbourhood store can also benefit from the range of choice and conveniences of Amazon’s Kisan Store. They can visit any one of the 50,000+ Amazon Easy stores across the country where the store owner will help them browse the selection, identify a product, create an Amazon account and place orders. Farmers can choose from a selection of thousands of farming equipments from over 20+ brands. This selection is offered by hundreds of Small and Medium Businesses present across the country.

Inaugurating the store, Shri Narendra Singh Tomar, Hon'ble Minister of Agriculture & Farmers Welfare, said, Addressing at the launch event, Shri Narendra Singh Tomar, Hon'ble Minister of Agriculture & Farmers Welfare said, “It gives me immense pleasure to launch Amazon Kisan Store. I hope this initiative proves to be beneficial for the farmers and the people associated with the farming community to engage the Indian farmers in the modern era of digital economy, increase the productivity of agricultural produce, provide services like logistics industry.

Many D2C brands across the country have surpassed the Rs100-crore benchmark in revenue. According to the Shiprocket-CII-Praxis report, grocery, gourmet, apparel and footwear and personal care are the largest D2C categories, together capturing more than 75% of the D2C market

Shiprocket, India's largest eCommerce enablement platform, has released a report on the D2C market in India in partnership with CII (Confederation of Indian Industries) and Praxis Global Alliance, a global management consulting and consulting firm.

According to the report, Direct to Customer (D2C) is a $12 billion market and is witnessing remarkable and rapid growth. The report states that several D2C brands in India have surpassed Rs 100Cr revenue in 3-5 years after launch.

The latest report shows that D2C brands represent an estimated $60 billion industry in FY27, at a CAGR of approximately 40%. The numbers in the report are staggering and pave the way for a new model of e-commerce in which brands choose to own and operate their own sales counters on the Internet. This remarkable trend has been reaffirmed by the fact that many D2C brands across the country have surpassed the INR 100-crore benchmark in revenue. Moreover, this revenue benchmark was only reached in 3-5 years since the start of the activities.

These trends are supported by the brands' agility and Go-To-Market (GTM) strategy, as well as strong digital capabilities that have helped their businesses grow and gain a competitive advantage. The report shows that branded packaging has also been a key factor in attracting buyers. The average order value (AOV) of each product and a hefty gain in gross margins are the fundamental headwinds driving this trend further.

Speaking about the report's launch, Saahil Goel, co-founder and CEO of Shiprocket said: "The rise of online-first shopping and conscious consumerism have fueled the era of direct-to-consumer (D2C) brands limited to marketing alone. of their products through online marketplaces or offline channels, quite a few brands are developing their own eCommerce stores or apps for the purpose of capturing orders and delivering them directly to the customers using eCommerce enablers. direct selling, this trend is continuing to newer heights.The rationale for direct selling is the same online as offline.Brands create their own branded stores and also sell in department stores or multi-brand outlets if they can control the brand experience in their own stores. Likewise, direct-to-consumer online channels empower brands to control the story and brand experience."

He added: "With this report, our aim is to provide the first-ever comprehensive deep dive of the D2C sector in India and its huge potential in the coming years."

Commenting on the launch, Praxis Global Alliance partner Mohit Mittal said: "The Indian e-commerce market is growing rapidly (estimated CAGR of 25% from FY22 to FY27). We have seen that almost all PINs in India use e-mail. commerce.Many of these transactions and orders come from second and smaller cities.By FY30, India will also have 1.3 billion+ smartphone users and 500 million+ online shoppers.The growing e-commerce sector is positively impacting D2C growth brands in India.With more people shopping online and more money being spent by consumers, the market is likely to expand in the next five years.To reduce their reliance on the marketplaces, even traditional brands are increasingly developing their direct-to-customer channels, such as tools for websites, apps and social media to reach and sell their customers."

To estimate the size of the D2C market in India, we considered seven categories: Personal Care, Apparel & Footwear, Groceries & Refined Foods, Jewelry, Electronics, Healthcare, Home Furnishings, Garden & Outdoor. Existing players (such as Unilever, Marico, Tata Consumer Products and ITC) are either acquiring prominent D2C brands or going the organic route to launch their own brands online and build their own D2C platforms. But for D2C brands to sustain this growth, they must amplify product innovation and renew manufacturing and sourcing strategies to become industry leaders. So to win the market, it is also essential to improve offline distribution, customer acquisition and unit economy.

Popular Categories on BuyBestBrands.in

Garden & Outdoors : Seeds, Plants, Plant Containers, Gardening Tools, Garden Decor, Pest Control, Barbecue & Outdoor Dining, Solar Power, Fertilizer & soil, Watering Equipment

Amazon Brand : Symbol, Inkast Denim Co, House & Shields, Jam & Honey, Solimo, Presto!, Symactive, Eden & Ivy, Vedaka, Tavasya, Myx